There's a real tension brewing. It's between those who trade and those who create digital collectibles. This conflict is heating up, especially as the NFT market takes a downturn.

Where's this strain coming from? It starts with major NFT exchanges. Think Blur and OpenSea. They've made a surprising move. They've cut down on artist royalties. This happens when ownership of a token switches hands.

What's the risk? Less income for artists.

Artwork at the Digital Art Fair in Hong Kong. Photographer: Lam Yik/Bloomberg

A 98% Drop in NFT Creator Payments

This could dry up new creations, causing the NFT market, already experiencing a 95% crash in trading volumes from $17 billion in January 2022, to remain stagnant. This data comes from Token Terminal.

In the heyday of January 2022, royalties reached $269 million. Unfortunately, in July this year, this figure was just $4.3 million.

This drastic drop was due to royalty transaction rates dwindling from a robust 5% to a measly 0.6%, according to researcher Nansen.

Phillip Kassab, growth lead for NFT and gaming at Sei Labs, worries about the balance. “It’s a myopic plan," he said. "They're overlooking that lasting success here rests on a delicate balance of championing both traders and creators.”

A bright period from August 2021 to May 2022 saw monthly royalties accumulate to an astounding $1.5 billion. This figure is according to Nansen, and credits the popular collections for the bounty, such as Yuga Labs Inc.’s Bored Ape Yacht Club.

Sadly, creator payments took a big hit. It happened when the NFT market wobbled. This came after the pandemic-led stimulus wave slowed down.

Response to a Bearish Market

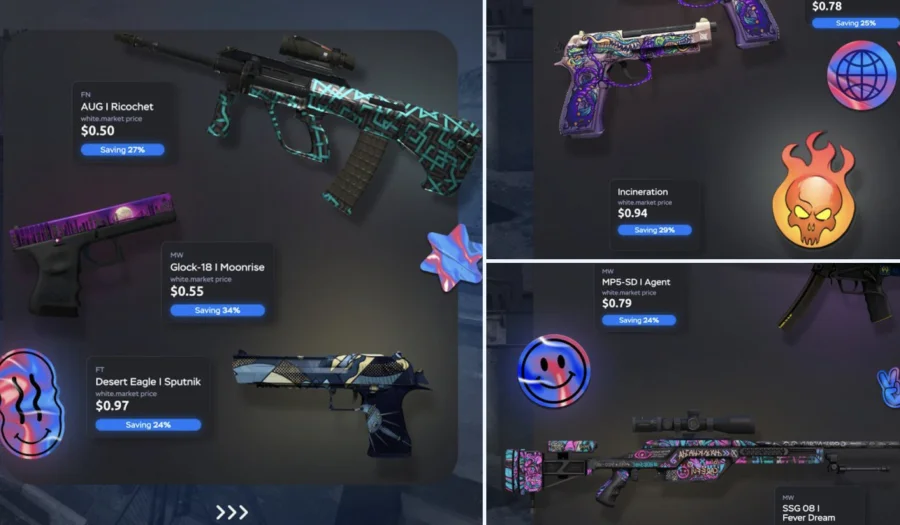

It was started when Blur burst onto the scene in October. It encouraged trading by cutting royalty rates.

Now it manages over 70% of daily volume on the Ethereum blockchain, according to Dune Analytics. OpenSea, the former giant, felt the pressure and had to adapt to Blur's strategy.

Ally Zach from Messari says, "Blur's launch led to NFTs becoming more financialized."

Many people ponder the future of NFTs. Critics argue their early popularity is just a fad. But people like Michael Winkelmann, also known as Beeple, disagree. He is famous for his Everydays NFT which sold for $69.3 million in 2021. According to him, the sector will bounce back and see growth.

Some propose that software should determine the royalty rates for NFTs, not exchanges. They want fixed, encoded rates. Others support platforms like SuperRare and Art Blocks, which ensure these payouts.

Chris Akhavan, the chief gaming officer at Magic Eden, says, "In web3, codes should drive rules, not social norms."

OpenSea has a mission. Shiva Rajaraman, the chief business officer, says it falls on them "to find new ways for creators to connect with their communities and earn a living – surpassing merely creator fees." An example could be tying NFTs with merchandise, sales of which could aid artists' income.

What Artist Said About This

Matt Kane is an NFT artist. He sold his "Right Place & Right Time" NFT for over $100,000 in 2020.

He worries about a drop in creator involvement. This could hurt the quality and range of NFTs. It could be more harmful than a temporary increase in trading volumes from lower transaction fees.

Kane has many collectors. These people appreciate the arts.

Some even pay him royalties after trading on a platform that doesn't enforce those payments. But not everyone sees things this way.

Kane believes in the promise of this new tech. He said, "It could take us to a win-win economy." "Everyone wins when one person achieves victory." But right now, he sees a move towards a win-loss economy.

It’s where one person's victory is another's defeat.

3 mins read

3 mins read