Welcome, curious minds! Today, we're venturing into the pulsating heart of the digital universe: NFT royalties. A financial revolution! They are transforming creator's earnings in ways unimaginable.

No tech guru? No worries! We're making the complex simple. You will understand its profound impact on creators' sustainability. Let’s get started!

Pixel Art NFT Collectibles Background. Vector Illustration. NFT Seamless Pattern

What are NFT Royalties?

NFT royalties provide creators with a way to continue earning income from their work even after the initial sale of the NFT. Non-fungible tokens (NFTs) have gained popularity within the Web3 ecosystem, with Ethereum leading the way followed by other blockchains like Solana and Bitcoin.

In the traditional Web2 world, protecting the intellectual property of creators and ensuring ongoing income is challenging. However, NFT royalties address this issue by enabling creators to earn a percentage of each subsequent sale of their NFTs. Whether it's music, art, game utilities, or any other digital asset, creators can earn passive income through royalties on each transaction.

The creator will always receive a percentage of sales, even if he sold NFT

The Need for NFT Royalties

NFT royalties serve several purposes in the ecosystem and offer significant advantages over the traditional Web2 model. Firstly, they provide a sustainable source of income for creators, making art and digital content a viable livelihood. Additionally, the programmatic nature of royalty payments allows multiple creators involved in a project to benefit from ongoing transactions.

From an economic standpoint, NFT royalties solve the challenge of tracking subsequent purchases of artwork in the Web2 creative sectors such as music, art, and graphic design. It is often difficult to enforce intellectual property rights and ensure creators receive fair compensation. With NFTs, every transaction is recorded on the blockchain, allowing creators to track and earn royalties at each point of sale.

Furthermore, NFTs enable creators to list and sell their works on various marketplaces without those platforms claiming direct royalty fees. This creates an economy that supports creators, a feature lacking in many Web2 business models. Royalties have also become an effective mechanism for funding the operational costs of NFT collections.

Another significant benefit of NFT royalties is their ability to combat unethical practices like wash trading. Wash trading involves artificially inflating the price of an NFT by creating fake demand through multiple transactions between accounts. By enforcing royalties on each transaction, the cost of maintaining high prices increases, discouraging wash trading and promoting a healthier marketplace.

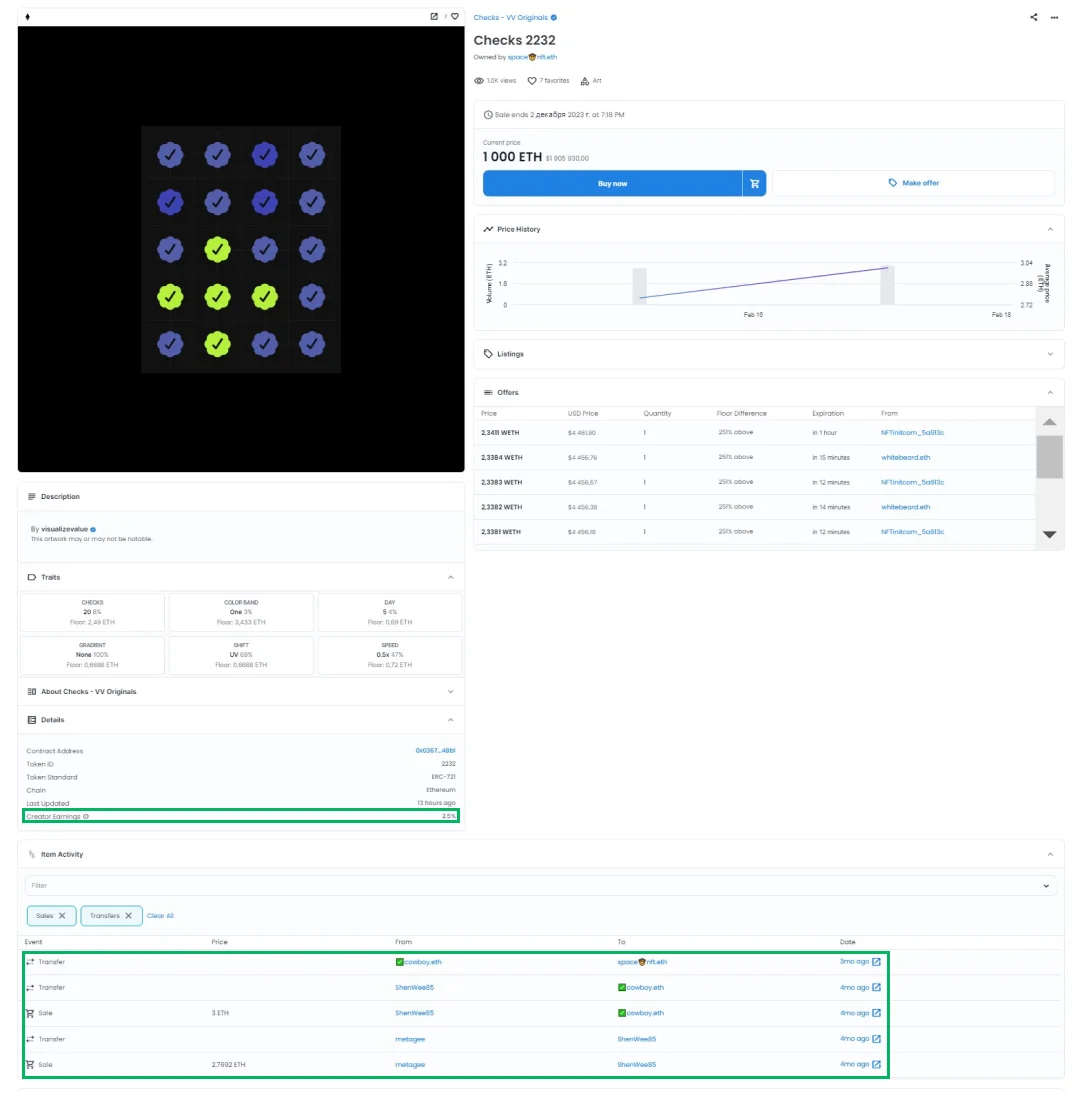

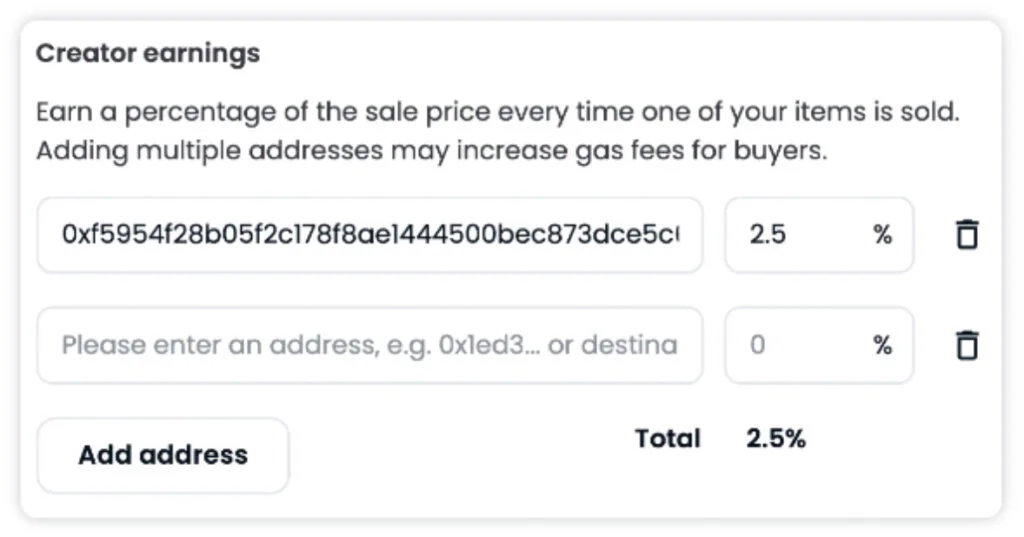

An example where everyone can see creator fee and items trade history on the marketplace OpenSea

The Role of Marketplaces in NFT Royalties

NFT marketplaces play a crucial role in facilitating the development, minting, and sale of digital content created by artists. These platforms provide creators with a space to showcase and sell their NFTs, as well as tap into the demand for secondary sales of their creations.

Within the Web3 ecosystem, each blockchain network has its own marketplaces, and there are also cross-chain marketplaces that facilitate the buying and selling of digital assets. Marketplaces contribute to the NFT royalty framework by providing a platform where creators can set and receive royalties on their NFTs.

However, marketplaces can also influence the ecosystem by setting royalty fees. This has a direct impact on NFT trading volumes, a key metric for assessing the health of an NFT collection or the overall ecosystem on a particular blockchain.

In order to provide customers the choice of paying royalties to the authors, marketplaces like OpenSea have experimented with either eliminating royalties or providing optional royalties. While such policies may give buyers more control, they can diminish creators' recurring income and make the creator economy less sustainable and competitive. It becomes challenging for newcomers to compete against established studios, undermining the innovation and vitality of the NFT space.

The Transformation of NFTs by Emerging Marketplaces

The past few years have witnessed the emergence of several NFT marketplaces, each employing different growth hacking strategies. Some strategies have positively impacted the industry, while others have had adverse effects on the ecosystem.

The marketplace landscape has shifted from organic growth to aggressive growth hacking, often through airdrop techniques based on NFT transaction activities. This approach arises from intense competition among new marketplaces during bear market conditions when liquidity is limited.

Marketplaces such as LooksRare, Solanart, X2Y2, OpenSea, OpenSea Pro, Rarible, Magic Eden, and Blur compete for creators, users, and liquidity. This competition has led to aggressive royalty competition. With reductions in royalty fees, It affects the overall ecosystem's health. Consequently, NFT projects, including well-known digital collectibles like Bored Ape Yacht Club and Azuki, have also decreased their royalty fees.

In response to these competitive dynamics, some marketplaces have chosen to block the sale of NFTs in secondary markets that do not support royalties. While this move has faced criticism, others argue that it is necessary to protect creators' interests.

A scenario where NFT collections cannot charge royalties poses challenges for their sustainability, as they become overly reliant on venture capital funding. However, venture capital firms are currently working this out and modifying how they approach supporting these projects.

The creator can choose the percentage of payments from future sales

The Future of NFT Royalties

Despite the challenges faced in recent months, NFT royalties remain essential for establishing a sustainable model for creators. They provide ongoing revenue streams and make art a viable source of livelihood.

In 2022, the Web3 world faced numerous hurdles, including rampant scams and price declines influenced by macroeconomic conditions. However, NFT royalties can play a crucial role in generating revenue for creators, fostering customer loyalty, and enhancing the overall brand experience.

Future developments such as dynamic NFTs, where metadata can be altered or upgraded, and intelligent NFTs incorporating artificial intelligence (AI) further fuel attention and loyalty economies within the Web3 space. These innovations deepen user engagement and attachment to NFTs, making them more valuable and relevant.

Given the benefits they offer, NFT royalties are likely here to stay. Companies embracing this business model may gain a competitive edge over their counterparts in the years to come, ensuring a sustainable future for creators and the NFT ecosystem as a whole.

5 mins read

5 mins read