The blockchain world keeps growing. Then, it's birthed an NFT sector. This field is bursting with cool things! Think NFT games. Think breaking NFTs into bits. There's more, too.

Each new thing boosts the NFT sector's value. Did you know, according to Statista.com, that the NFT market could hit $3.1 billion by 2027? Wow, right!

Robert Masiello Opinion

Now, you might wonder. With a $3.1 billion aim for the next four years, what is going to fuel this huge growth?

Let's hear from an expert. His name is Robert Masiello. He helped establish arcade.xyz. Recently, he talked about NFT Finance at a big event, ETHCC Paris.

Robert shared interesting stuff on how the NFT sector is growing. He also gave his views on what the future holds. It's exciting!

First off, he explained what NFT Finance means. It’s services and items built around NFTs.

This NFT Finance thing started with NFT loans. Now, guess what? It's grown! You can find things like derivatives, AMMs, aggregators, and more.

Robert broke down the NFT finance world into four big parts.

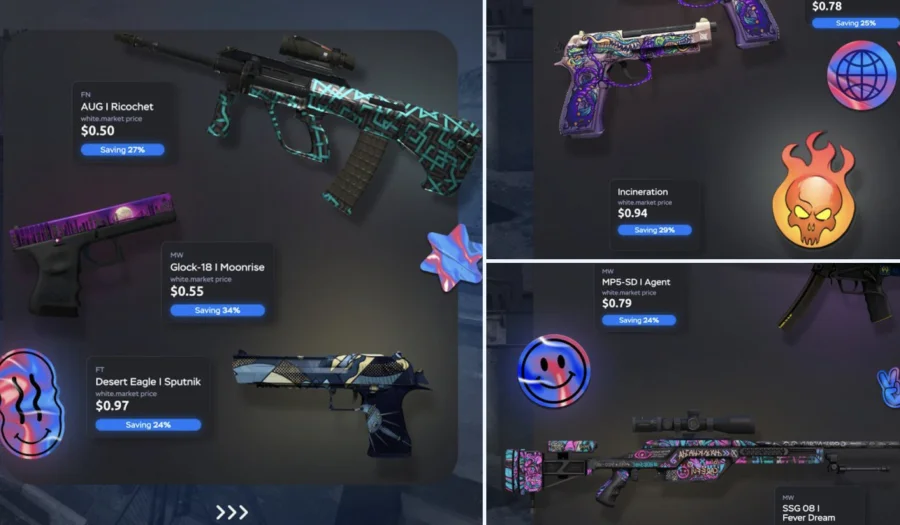

- Firstly, Lending. It's where people borrow money. They use their NFTs as the promise to pay back. Some examples are CryptoPunks, Mutant Apes, and Board Apes.

- Secondly, Derivatives. This is a pretty fresh idea. Yet, it includes things like options and perpetuals.

- Thirdly, Aggregators. Platforms like Goblin Sacks, Spice Meta Street, and Snow Genesis are leading.

- Lastly, there are Buy Now, Pay Later and Fractional Investing. It sounds cool, right?

But here's a twist. Robert points out that these numbers may hide the real growth. The ballooning value includes some buy-now-pay-later deals, which aren't backed by cash in hand.

That's not all. More and more folks are stepping up to try their hand at NFT lending. In fact, we've seen a wave of new users - tens of thousands!

Still, we need to keep our eyes open. NFT is still growing with room for more. Interesting fact - there are more unique NFT traders (18,000 in fact) in the same span of time.

A Peek Into The Future

Want a forecast? During his talk, Robert called out some trends that could shape NFT's destiny.

First off, NFT might head for more Layer 2 love, leaving Layer 1 behind.

Why, you ask? Most protocols favor Layer 1 because it's where the big money hangs out.

Robert hints that Layer 2 adds more flavor, fixing some pesky limitations. By going with Layer 2, we get swift transactions and smoother interactions with NFTs.

Plus, Layer 2 could cut down on traffic jams and pricey network fees.

What else? How about Asset Diversity? Robert says the NFT space needs fresh variety, not just high-price tokens.

Diversity helps the whole NFT world. It helps cook up new inventions, like derivatives and other clever items. When the asset pool swells, more investors can dip their toes into the NFT pond.

The Rise of Aggregate Platforms

Next up, Robert talks about changes in aggregation platforms. It's all part of NFT's exciting horizon.

He pitches an idea: what if we had platforms that gather all NFT stuff in one spot?

Sounds useful, right? It could help folks see loan and borrowing options at a glance, making the NFT maze a bit easier.

What's more? He talks about blending real-world assets with NFT finance and the buzz around Decentralized Autonomous Organizations (DAOs).

This mix could make NFT more appealing to many. It loosens the tie between old-school finance and NFT, closing the gap between the two.

As for DAOs, they let community folk have a say in decisions, making the NFT world a bit cozier and a lot more ours.

3 mins read

3 mins read