The NFT market has experienced remarkable growth in recent years, with new entrants and existing platforms broadening their services. However, with this growth comes competition, and this is evident in the conflict between Blur and OpenSea.

This blog post will explore the clash between the two platforms and its influence on the NFT landscape.

Blur vs. OpenSea Comparison

One of the key differences between Blur and OpenSea is their target audience. While OpenSea caters to a wider range of NFT holders, including casual traders, Blur positions itself as a platform for "whale traders". Additionally, Blur boasts zero trading fees, while OpenSea charges a 2.5% fee on sales.

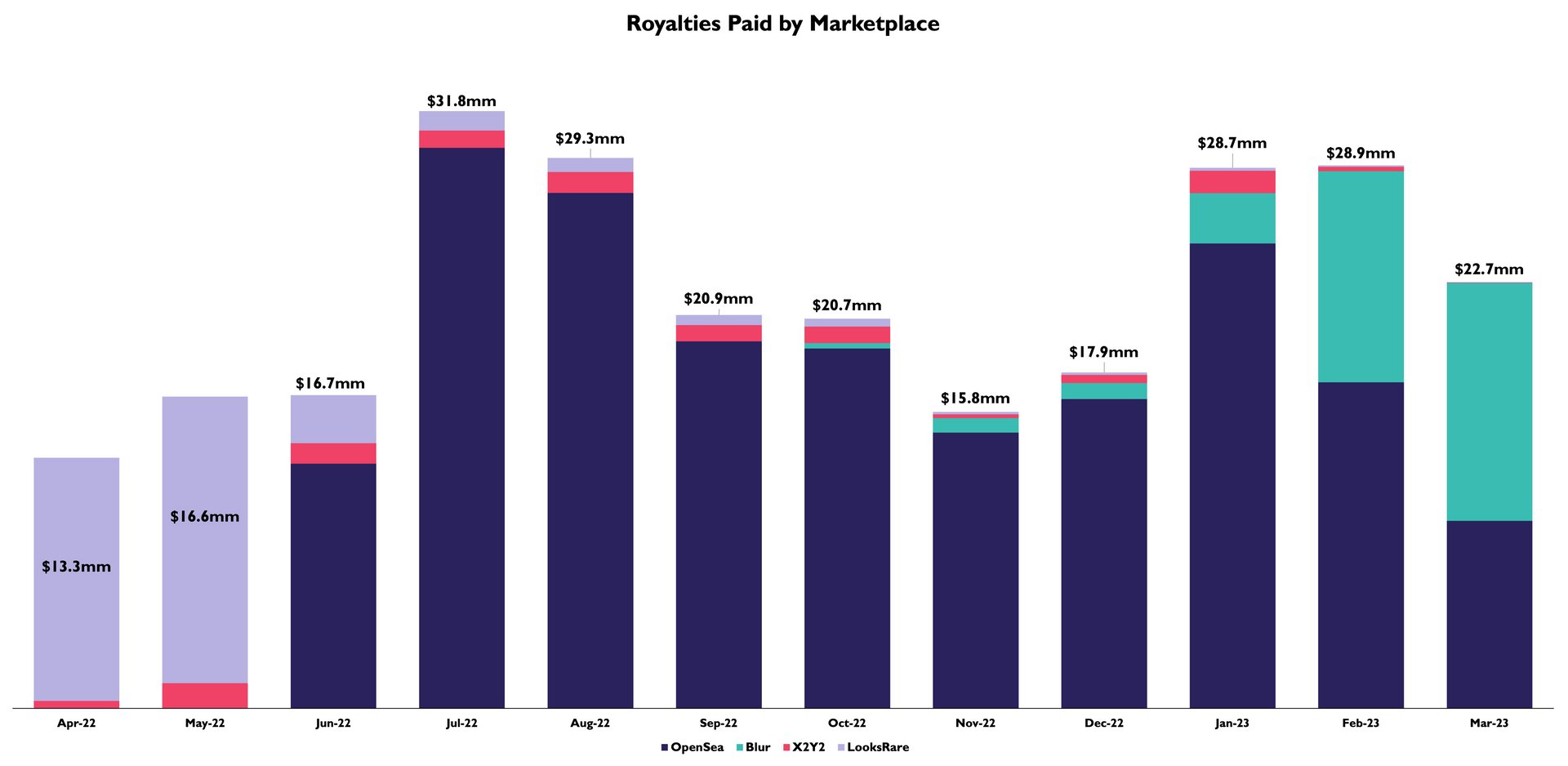

Royalties Paid by Marketplace

How the Conflict Started

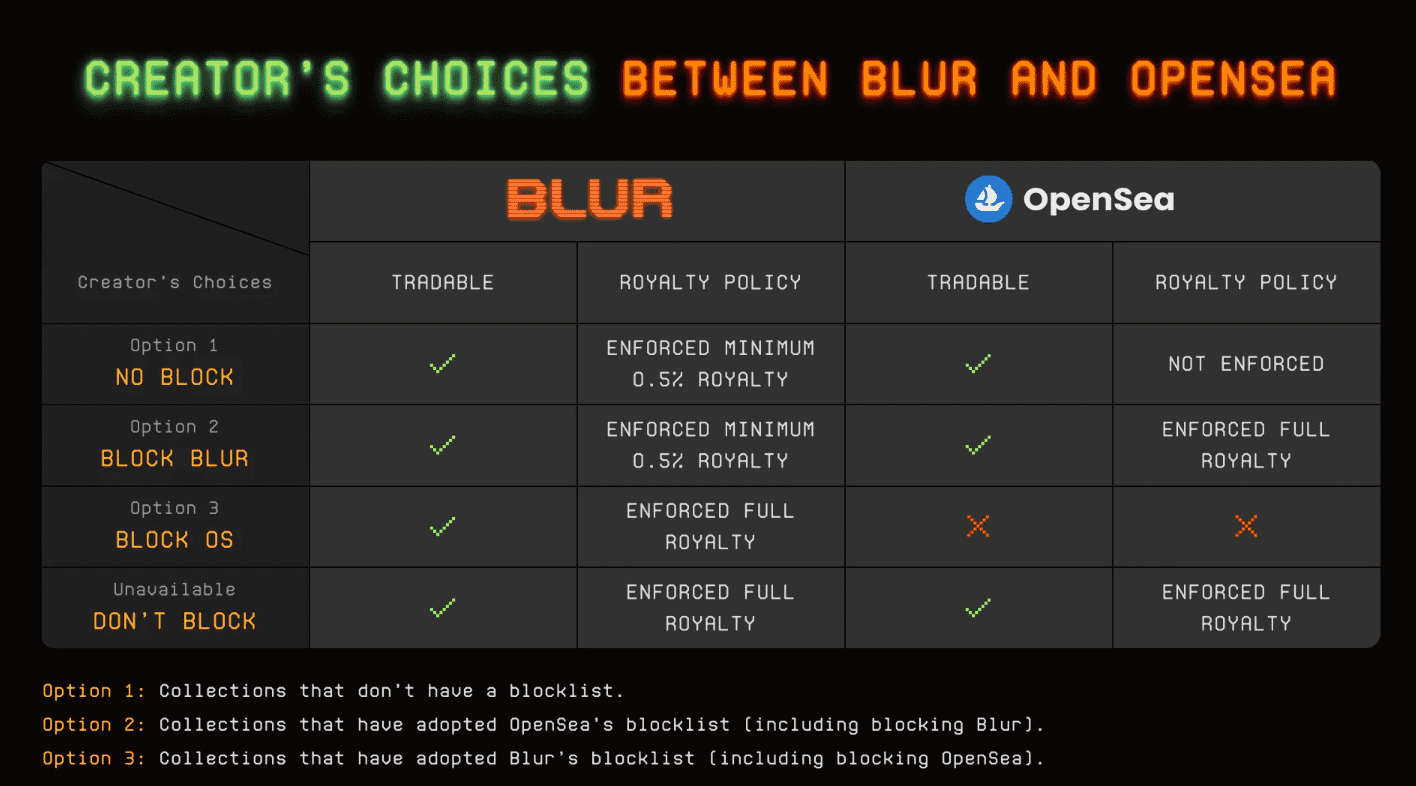

One of the main points of war between Blur and OpenSea is the issue of creator royalties. With the release of a mechanism for royalty enforcement, OpenSea started enforcing its policy on smart contracts established after January 2, 2023, having first argued for the mandatory creator royalties determined by the author.

This led to a major conflict between OpenSea and Blur, with Blur suggesting that creators limit sales on OpenSea to receive full royalties on its platform. In fact, Blur went so far as to advise NFT producers to completely ban OpenSea in a blog post that outlined the differences in royalty payment choices between its platform and that platform.

How It Affects Market Share

Despite the conflict, Blur has been gaining market share in the NFT space. A report claims that in February 2023, the platform held 6x4.8% ($1.32 billion) of the NFT market share, partly as a result of NFT whale farming there. However, OpenSea is still a dominant player in the market.

How It Affects Users

One of the most notable impacts on users has been the reduction of trading fees by both platforms in response to the competition. While Blur initially reduced its fees to zero, OpenSea also eliminated its 2.5% fee on sales. Additionally, the conflict has resulted in increased transaction fees on the Ethereum network due to the higher demand.

Users have experienced modifications in the user interface and capabilities of both platforms. Blur's interface provides more data for active traders, and its use of the Seaport Protocol allows it to bypass OpenSea's blocklist. OpenSea has responded by reducing creator royalty protections and making other changes to its platform.

Implications for the NFT Market

The conflict between Blur and OpenSea highlights the importance of creator royalties in the NFT space and could lead to greater competition and innovation in the marketplace. It is still unclear how this clash will ultimately affect the platforms and the entire NFT market.

The conflict between Blur and OpenSea is an example of the intense competition in the NFT market. While each platform has its own approach and features, the issue of creator royalties has become a significant point of contention. As the NFT market progresses, it will be intriguing to observe the outcome of this dispute and its consequences for the entire market.

3 mins read

3 mins read