Mila Kunis's project named 'Stoner Cats' was in trouble. The United States Securities and Exchange Commission filed a case. This Commission, we'll call it SEC, was not happy. The reason was the Stoner Cats project, initiated in 2021.

Stoner Cats 2 LLC was the creator of this project. The accusation was that they sold things without proper approval. These things are known as unregistered securities.

The Securities and Exchange Commission says NFTs tied to the Stoner Cat series backed by Mila Kunis and Ashton Kutcher are unregistered securities

The Outcome of the Case

The result was a compromise. Stoner Cats 2 LLC didn't admit wrongdoing. Still, they settled with certain actions. They agreed to stop certain practices. Also, they promised to pay $1 million in penalties.

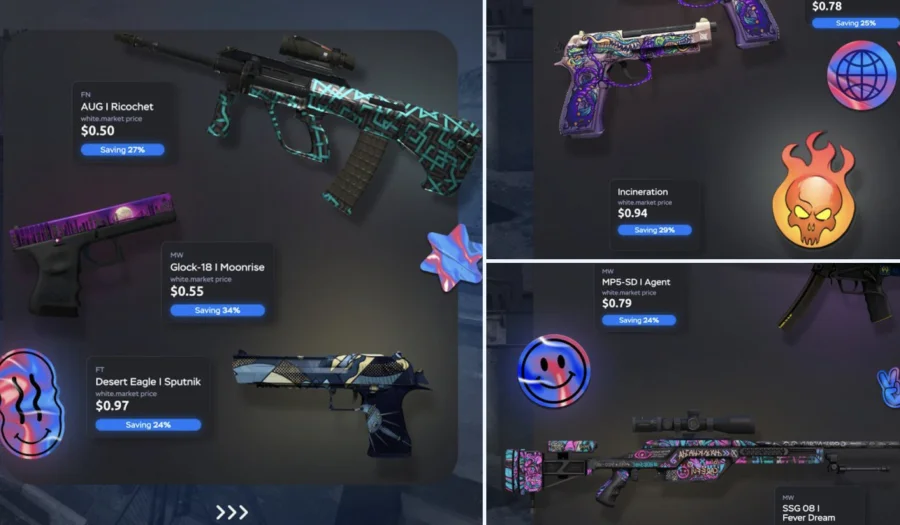

Extra steps were taken for fairness. It meant they would destroy certain digital items they still had. These items are NFTs, short for Non-Fungible Tokens. They also offered refunds to people who bought these NFTs in the first sale.

About the Stoner Cats Project

Now, let's talk about the project itself. 'Stoner Cats' was an animated show. Orchard Farm Productions, owned by Mila Kunis, made it. Mila Kunis also did a cat's voice in this show.

The project collected $8 million in a sale. Users bought Ethereum NFTs for access to the show. Buying an NFT granted access to the web series. This series showed five cats. It has their owner behaving strangeness after consuming a plant.

The show boasted a star-filled cast. The cast included Ashton Kutcher, Mila Kunis's husband. Jane Fonda, a famous actress, gave her voice, too. Seth McFarlane, the creator of 'Family Guy', was also involved. Chris Rock, a well-known comedian, joined them. A special guest, Ethereum creator Vitalik Buterin, made an appearance as a stuffed cat! This was his first time in Hollywood.

The SEC's Allegations

Finally, the SEC made an accusation. The project, Stoner Cats NFT, messed up.

They sold something problematic. It was unregistered securities. Why is that bad? It breaches federal securities laws.

The NFTs became hot cakes. They disappeared in just 35 minutes. But what lured people? The company showcased benefits. Benefits of owning these NFTs.

Majorly, one could resell them. Where? On other markets, the secondary. The company got perks too.

They earned a royalty fee. Then, a person spoke up. It was Gurbir S. Grewal. He directs SEC's enforcement army. He referenced beavers and chinchillas. Why wouldn't he miss animal-based NFTs?

He said something vital. No matter what your offering is, laws apply. The laws, the federal securities ones. The determinant? It's the offering’s economic reality.

Not the tags you stick. Not the underlying items. They guide something important. What is it? The definition of investment contract. Eventually, the term "security."

Final Thoughts

Stoner Cats wasn't alone. They were but the latest. In SEC's series of action. Against whom? Celebrities and notable influencers. The ones that sold NFTs.

Remember Tom Bilyeu from August? An entrepreneur with a media company. Impact Theory, it's called. They paid a big price. Six million dollars for a settlement.

They offered the Founder's Key collection. It suffered the same fate as Stoner Cats. It means, they had to destroy it.

3 mins read

3 mins read