Impact Theory, a company in LA, got in trouble. They have to pay $6 million.

Why? They sold something they weren't supposed to. It was a type of digital collectible called an NFT. But the SEC, a government agency, said they didn't follow the rules.

How It All Started

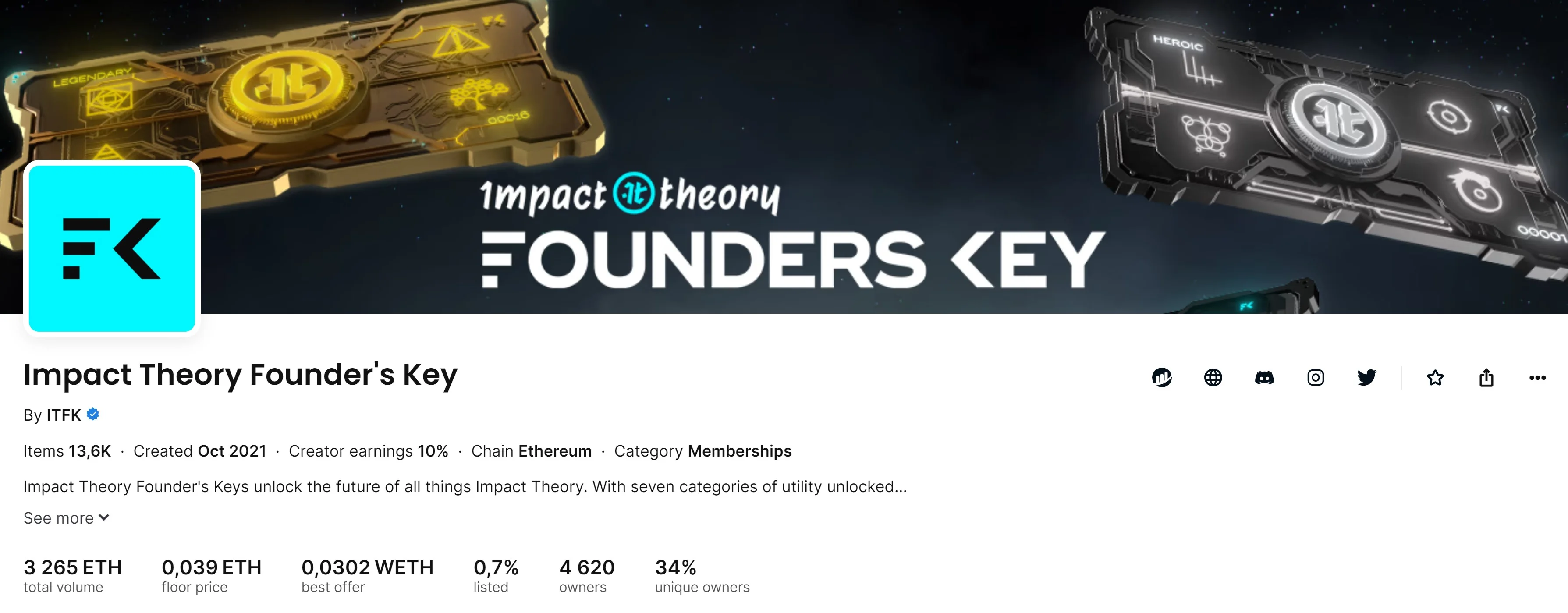

Impact Theory made something called the Founder's Key. People could buy it on a website called Opensea. This all happened even after they got in trouble.

Even now, you can still buy one for 0.039 Ethereum. That's like $64. The total amount people have spent on Founder’s Key is $5.4 million. Tom Bilyeu started Impact Theory. He’s a big name on social media and a business person.

Allegations and Settlement

So, what did Impact Theory do wrong? The SEC has made some accusations. From October to December 2021, Impact Theory sold three kinds of NFTs. These NFTs were named "Founder's Keys".

Source: OpenSea

They were tagged as "Legendary", "Heroic", and "Relentless". Impact Theory told people that buying a Founder’s Key was like investing. They hinted that buyers would make money if Impact Theory did well. They often compared themselves to big entertainment companies like Disney.

The SEC now thinks these NFTs were something else entirely. They think they were like stocks but didn't follow the rules. To fix this, Impact Theory has agreed to stop and avoid this mistake. They didn't say they did anything wrong. They also didn’t deny it. Now they have to follow the 1933 law called the Securities Act. That's why they need to pay $6.1 million.

Settlement Details

A settlement was made. It has three parts. It has disgorgement, prejudgment interest, and a civil penalty. A Fair Fund is also being created. It helps to return money to hurt investors. The company must also destroy Founder’s Keys. They need to make this order known online. Plus, they must also promise not to want royalties from Founder’s Keys in the future.

SEC did it in their New York office. They had support from the Enforcement Division's Crypto Unit. The Division of Economic and Risk Analysis also helped.

Not Everyone Agreed

Five people at the SEC had to decide. Two of them were not happy. They were Republicans called Hester Pierce and Mark Uyeda. They thought that the SEC should have clarified about NFT offerings. They should have done this before taking action against Impact Theory.

The lawsuit shows that more might come. More SEC actions against NFT projects.

In fact, there was another big case before this. It was in New York against Dapper Labs. They were accused of selling unregistered securities. In February, a judge said Dapper Lab’s could not dismiss the case.

Final Thoughts

So, in the end, Impact Theory might have made a big mistake. They wanted to be creative with NFTs. But they didn't stick to the rules. And now, they have to pay a big price.

Sometimes, it's essential to do things the right way and follow the rules. The world of technology and digital collectibles is new and exciting. But always remember, doing things the right way is important, whether it's old school or the future.

3 mins read

3 mins read